⚠️ ALERT: IMPORTANT INSURANCE DELIVERY REQUIREMENTS

(Please read carefully — failure to follow these rules voids your shipping insurance.)

Your insurance coverage will be void, and you will be entirely responsible for any losses resulting from lost or stolen packages, if you have done any of the following (quoted verbatim from our insurer’s requirements):

- left instructions with any carriers or delivery service to leave parcels unattended,

- requested to waive the required signature, and/or

- advised any delivery personnel to leave your package with someone else other than who is listed on the shipping address, including but not limited to a building manager, neighbor, or drop-off location.

Help us protect you — please ensure you are available to sign for your package. You will receive tracking information so you can adjust your schedule accordingly.

Do not violate the above conditions. If you do, our insurance policy is automatically void, and SHM will not be able to reimburse you for any losses as a result.

We believe in being as reasonable as possible — but on this point, we must be as strict as possible.

______________________________________________

This specific Sales and Purchase Agreement applies only to certain types of transactions with Safe Haven Metal LLC.

We use four different contracts depending on the type of transaction:

This contract on this page does not apply to:

IRA transactions

When we purchase precious metals from you

This contract on this page does apply to you when:

Purchasing on this website

Purchasing on this website

Purchasing from us for at-home delivery

Website Sales Transaction and Purchase Agreement

Sale and Purchase Agreement with Safe Haven Metal— Terms and Conditions

This document/webpage shall serve as a legal contract, setting forth the terms and conditions of the items either listed on the Invoice or placed in your cart and purchased on the checkout page (hereafter collectively referred to as “Invoice” to match our standard physical contracts), and contains important information regarding your rights and obligations, as well as conditions, limitations, and exclusions that might apply. Please read it very carefully.

The conditions of this Agreement contain the mutual agreement to require the use of arbitration on an individual basis to resolve any disputes that may arise from this agreement, replacing and waiving the right to resolve the dispute in a court of law or equity inclusive of jury trials or class actions suits. This also contains a stipulated damage provision after payment has been made in full and full delivery of the goods have both been fully performed by the parties and is triggered by specified events. (See Section V below).

Placement and fulfillment of an order for products involving precious metals with Safe Haven Metal LLC is contingent on your affirmation that you are of legal age to enter into this agreement, and you accept and are bound by the terms and conditions herein. You affirm that if you place an order on behalf of an organization, company, trust, entity or government, you have the legal authority to bind any such entity to these terms and conditions of this agreement.

Recitals

SAFE HAVEN METAL LLC, a California limited liability company (hereafter, “SHM”) is engaged in the business of purchasing and selling Precious Metals and goods, we are not a mining company nor a Mint. SHM and you as the customer (hereafter “Customer”) agree, that the terms set forth in this Transaction Agreement (“Agreement”) shall govern this transaction between the Parties involving the purchase and sale of Precious Metals in any such form or quantity as designated on the Invoice.

This Agreement contains the standard terms and conditions applicable to all purchase and sales transactions between SHM and its customers as to the type of Delivery noted in the upper right corner of this page if a document or will be for personal physical delivery if online. The specific details pertaining to the unique exact name, address, payment method, delivery dates, the details of a specific order and value of consideration exchanged, etc., is set out in the Invoice attached as page 1 of this Agreement to each specific Customer for a particular transaction or as listed on the checkout page for Customer’s order. This Agreement is materially incorporated into each Invoice as referenced on the Invoice, and why this page is numbered 2; or if online requires checking the box for acceptance or the sale will not complete.

The language used is intended to be plainer English and communicates legal ease by description of its intended meaning so that Customer understands, any non-use of legalese is not intended to not use the concept communicated by plain English, yet sometimes legalese is the only way to say something. As a result, this Agreement is a bit longer than it could have been, but with the aim that you understand all of it, not a fraction of it.

If signing this document in PDF form, I understand that by initialing at each location where indicated herein this Agreement, that I am communicating that I have read and understood and have asked questions regarding anything I did not understand and now do understand, evidenced by my initials. If purchasing online, I understand that by clicking the box at checkout that I am communicating that I have read and understood and have asked questions regarding anything I did not understand and now do understand, any aspect of this agreement and by clicking the acceptance of the terms and conditions will be deemed an initialing of each location herein and confirm my agreement to these provisions.

I. DEFINITIONS

- Definitions of particular words that appear capitalized when used herein:[1]

- “Agreement” refers to this document in its entirety without reference to any outside materials, and sets forth the entirety of the terms and conditions binding upon the parties.

- “Bullion” Platinum, gold or silver in the form of bars or other storage shapes, including coins and ingots.

- “Bullion Coin” Precious metal coin traded at current bullion prices

- “Cash Sale” or “Cash Transaction” is an industry term related to the method of payment by Customer, it does not mean literal physical paper money, but refers to the transfer of United States currency through bank to bank transactions and includes FedNow, ACH transfers, wire transfers, e-checks, and certified cashier’s checks. Due to Anti-Money Laundering regulations and for security for our clients, SHM DOES NOT ACCEPT ACTUAL PHYSICAL CASH PAYMENTS.

- “Customer” means the other party to this Agreement that is not SHM, it includes you, as either a person, trustee, company, LLC, corporation, government whatever the case may be.

- “Customer’s Address” is required to be the billing address associated with the bank account used to tender the electronic payment for any Cash Sale; SHM will only ship to a different address than an address associated with the Customer’s bank account if a certified cashier’s check is used, this is done to ensure the safety of our Customer’s funds and prevent identify theft.

- “Flat Rate Insured Alaska and Hawaii” means the required insured shipping fee applied to all shipments to Alaska or Hawaii and are fully insured for coverage up to one hundred percent (100%) of the total Invoice amount in the event of loss during transit and is excluded from the definitions of Premium Insured Shipping and Standard Shipping. See paragraph 9 of Section III. (Read What Voids Your Insurance Protection)

- “Good Funds” means the verified receipt of immediately available funds according to the applicable requirements of federal Regulation CC.

- “Grading” is a highly detail oriented field of the evaluation, assessment and appraisal of Numismatic coins. A coin’s condition is graded on a scale of 1 to 70 by experts with specialized training using a rigid set of guidelines. Coins with a grade of 70 are considered flawless. This requires training and schooling and is done by companies that specialize in this field e.g., Professional Coin Grading Service, Inc., Numismatic Guaranty Corporation of America, and ANACAS

- “Invoice” is the attached document titled Invoice that sets out the specifics as to Customer’s specific transaction and any details of the particular Precious Metal(s) involved, or as stated on the website checkout page.

- “IRA Transactions” is an all-inclusive term regarding any form of retirement savings account, inclusive of: 401(k); 403(b); 457(b); IRA (traditional, Roth, Simple, SEP); Pension plan; Tax-sheltered Annuity; and/or Thrift Savings Plan (TSP).

- “Mint” A place where coins of a country are manufactured under government authority

- “Non-IRA Transaction” is intended to exclude the named accounts in 10.

- “Numismatics” The study and collecting of things that are used as money, including coins, tokens, paper bills, and medals (Learn more at numismatics.org; or American Numismatic Association money.org)

- “Numismatic Gold” refers to collectible gold coins that hold more value than the spot or current market price of gold. The increased value is largely due to rarity, age, and other factors.

- “Precious Metals” either plural or singular means, for purposes of this Agreement, any of the following Precious Metals: (palladium (Pd #46), silver (Ag #47), platinum (Pt #78), gold (Au #79)) in any form, quality or quantity, derived from any location or Mint.

- “Premium” is an industry term within the Precious Metals industry, that means the difference between a company’s cost for the Precious Metals or goods purchased and the retail price quoted to Customer, that is known as the Premium. E.g., 10-9=1, 1 is the Premium.

- “Premium Insured Shipping” means an optional shipping benefit offered for the price stated on the Invoice that provides full indemnification insurance coverage up to one hundred percent (100%) of the total Invoice amount (less this fee) in the event of loss during transit, contingent upon Customer providing notice to SHM within a reasonable time after discovering such loss, and further includes an inconvenience coupon redeemable as a one-time fifty dollar ($50) discount on Customer’s next purchase over nine hundred ninety-nine dollars ($999) made through safehavenmetal.com, which is not redeemable for cash and is not valid for purchases made with any other company. This does not relate to time in transit or shipping speed. See definition of Standard Shipping and see paragraph 9 of Section III. (Read What Voids Your Insurance Protection)

- “Price-Lock Reserve” is a required amount for Customer to lock in a price at the time of Invoice and permits Customer three banking days to send the required bank wire for payment in full in good funds. SHM will place a credit-card reserve in the amount noted on the Invoice. If Customer cancels or does not complete the bank wire within the time required, then Customer will be charged only the actual market loss (up to the noted amount). However, if Customer timely completes the bank wire then the credit card will not be charged and the reserve hold will be released.

- “Purchase Price” means all funds paid by or on behalf of Customer to SHM under this Agreement (or to another person at the request or direction of SHM), including, but not limited to, the sale price of a Precious Metal, an administrative charge or fee, assessment, deposit, dues, handling charge or fee, holding charge or fee, membership charge or fee, reservation charge or fee, or any charge, fee, or other payment made or paid in connection with the sale under this Agreement.

- “Spot Price” is the price at which a physical commodity for immediate delivery is selling at a given time and place.

- “Standard Shipping” applies to all Customers who elect not to purchase Premium Insured Shipping and therefore acknowledge and agree that, in the event of loss during transit, indemnification shall be limited to ninety-eight and one-half percent (98.5%) of the Spot Price as determined at the time of purchase as per the Invoice, and expressly waive any right to recover or claim the remaining balance and release SHM from all liability for any damages, including but not limited to direct, incidental, or consequential damages. This does not relate to or affect shipping speed. See definition of Premium Insured Shipping and see paragraph 9 of Section III. (Read What Voids Your Insurance Protection)

- “Substitute Delivery” means actual physical delivery of the items specified on the Invoice to: a financial institution; a depository, the warehouse receipts of which are recognized for delivery purposes for any commodity on a contract market designated by the Commodity Futures Trading Commission; or a storage facility licensed or regulated by the United States or any agency thereof. As required by California statute, Corp. Code, § 29531(b).

Any other words used herein are intended to mean their common accepted understanding, and any legal terms of art are intended to mean their common legal accepted understanding under California law, words as defined above will be capitalized.

[1] Any defined word that is in bold was a definition taken directly from the U.S. Mint Glossary https://www.usmint.gov/learn/collecting-basics/glossary

II. PAYMENT

- Full Payment due by Close of Business on Date of Invoice, time is of the essence.

- Time Limit Placed on Acceptance of Offer. For Cash Transactions with actual physical deliver to Customer’s Address, Customer shall ensure that payment has been made in full by close of business at five o’clock (5:00PM) Pacific Time on the date stated on the Invoice to ensure the price on the Invoice is locked in, due to the current changes in market value SHM cannot honor today’s price tomorrow. Therefore, before SHM can be obligated to actually physically deliver the quantity of each Precious Metal purchased under this Agreement as described in the Invoice, the total Purchase Price shall be paid in Good Funds within the required time, thereafter actual physical delivery of the quantity of each Precious Metal purchased shall be personally received by Customer no later than within 28 calendar days from the date of the partial payment in Good Funds, although usually the items purchased on the invoice are delivered in two days up to five days. See Section III for additional details.

- Time is of the essence[1] on payments due because of the fluctuating market value of Precious Metals and the commitments made by SHM to its suppliers that are made in detrimental reliance on the representations by Client of a desire to execute a purchase through SHM.

- CANCELLATION POLICY. There is no unilateral right to cancel this Agreement except as expressly provided in Section III.Any other attempted cancellation would inject uncertainty into the transaction, undermine the definite purchase intent required for a valid cash-sale precious-metals contract, and risk reclassification of the transaction as a commodity option or futures contract prohibited under California Corporations Code § 29520. SHM immediately takes action in reliance on all Agreements whereafter additional contracts are made by SHM with its sources to lock in deals and acquire desired items listed on the Invoice and fulfill our shipping commitments and obligations to not only Customer but all SHM customers; SHM will not be able to rescind our agreements with third parties. Accordingly, all non-nullified portions of this Agreement are final, binding, and not subject to discretionary cancellation or rescission.

- CHARGE TO CREDIT CARD. If Customer elects to pay by bank wire then a credit card is required for the Price-Lock Reserve and SHM will then place a reserve hold for the specified amount stated on the Invoice on customer’s provided credit card. In the event Customer fails to complete the bank wire payment within the stated grace period then Customer authorizes SHM to charge Customer’s credit card for any amount of market loss or other damages SHM incurs for cancelling its contracts with third parties, but no more than the Price-Lock Reserve amount as stated on the Invoice. SHM will not charge Customer’s credit card if the bank wired funds are sent within the stated grace period and payment in good funds is timely received.

- ALL SALES FINAL. Except when Section III is applicable, after delivery of each items listed on the Invoice, then upon such delivery the sale becomes a final sale. SHM does not offer refunds or make exchanges. See Buy Back Policy for additional options made available to Customer.

- Upon delivery, Customer will receive an exact itemized list of all Precious Metals being delivered as provided with the shipment by one or more of our vaulting locations for Customer to compare to the Invoice and to keep for Customer’s records. These are very important documents, keep them in a safe location.

[1] Time is of the essence is a legal term meaning any time period stated is a strict time period. When any specific time does not state time is of the essence the law understands it to mean reasonably within that time under the circumstances.

III. DELIVERY OF PRECIOUS METALS

- Delivery and Performance

- Delivery for Cash Transactions. SHM shall cause all Precious Metals purchased to be delivered to Customer’s address no later than twenty-eight (28) days after SHM’s receipt of Good Funds in full satisfaction of the Invoice. SHM shall use its standard methods for packaging and shipping such goods through a nationally recognized, reputable shipper and shall insure the shipment. All shipments require a signature upon delivery, and SHM will provide tracking details once shipped. Upon delivery of each item in the Invoice to Customer, SHM’s obligations are deemed fulfilled and SHM shall have no further liability regarding such item; and Customer acknowledges and releases SHM from all liability resulting therefrom.

- IRA Transactions Excluded. California law provides that deliveries of Precious Metals to be stored on behalf of a customer, known as substitute delivery, are exempted from Cal. Corporations Code § 29520 per § 29531(b), therefore this contact is not permitted to be used for IRA transactions or any transaction involving substitute delivery to the named entities in said statute. SHM employs a different contract for such transactions.

- Contract Intent is to Align with Legislative Purpose and Compliance.

When California and most other states enacted their version of the Blue Sky Laws, Chapter 969, Statutes of 1990 (p. 4065) commenced with Section 1: “It is the intent of the Legislature to protect investors from fraudulent commodities transactions while recognizing the interests of those engaged in legitimate commodities transactions by filling a regulatory void”.

The twenty-eight (28) day delivery structure contained in this Agreement is designed to comply with, and give effect to, that dual purpose of consumer protection and legitimate-business promotion. Consistent therewith, this Agreement requires SHM to complete delivery within twenty-eight (28) days of receipt of Good Funds; and further provides that, if circumstances outside of SHM’s control prevent timely delivery as to any portion of the Invoice, then this Agreement automatically self-nullifies the affected portion and grants the Customer full authority to direct the disposition of Customer’s funds under paragraph 9 of this Section.

SHM was required to take these additional steps to protect consumers from being made into criminals when circumstances beyond the parties’ control preclude complete execution. Cal. Corporations Code § 29520 prohibits any person—including both seller and purchaser—from entering into or purchasing under a commodity contract unless specifically exempted. And § 29505 only excludes this transaction from a commodity contract if the Precious Metals are actually received within twenty-eight (28) days. No provision of law contemplates exclusion for circumstances beyond the parties’ control. Thus, by self-nullifying under such circumstances, the affected portion of the Invoice is no longer a commodities contract — because it “is comparable to a blank piece of paper” (105 Cal.App.2d at 733). Without this, both parties would now be made criminals by the acts of a third party that isn’t even committing a crime.

The provisions of this Agreement are intended to ensure that SHM’s transactions remain cash-sale precious-metals transactions and never commodity contracts, thereby honoring both the letter and the spirit of the applicable statutes by protecting Customer from the risks those statutes were enacted to prevent while promoting the business they sought to preserve. - Partial Fulfillment and Split Shipments. The parties intend to complete as much of each transaction as feasible within the required period. If, in SHM’s opinion, fulfilling an entire order within twenty-eight (28) days would be delayed due to inventory, supply, or insurance limitations, SHM may create two or more Invoices and may ship each Invoice’s listed Precious Metals separately. Each Invoice shall constitute an independent contract and shall not be construed together under Cal. Civ. Code § 1642. To the extent any original Invoice cannot be fully completed by the parties due to insurance limitations, inventory, or supply of Precious Metals then paragraph 8 of this Section shall apply.

- Loss During Shipment. If a loss occurs during shipment prior to delivery to Customer, Customer must immediately notify SHM upon discovering the loss. SHM will open an investigation with the appropriate carrier. Due to the fluctuating availability of Precious Metals and the proximity of the twenty-eight (28) day delivery deadline, the parties agree that paragraph 8 of this Section shall automatically apply to the affected portion of the Invoice. (Read What Voids Your Insurance Protection)

- Voluntary Assistance Upon Delivery. To the extent reasonably possible, if Customer suffers loss at or after delivery, SHM will assist in obtaining verification from the shipper of the delivery signature, a statement from delivery personnel, photographs, or other evidence that may be available to assist Customer. Customer is advised that it is Customer’s responsibility to immediately notify law enforcement and request that a report be made, and to promptly notify SHM so that SHM may contact the shipper and provide Customer and law enforcement with any available information to assist in the investigation. (Read What Voids Your Insurance Protection)

- Force Majeure. Neither SHM nor Customer shall be liable for any failure or delay in its or their performance under this Agreement due to any cause beyond its or their respective reasonable control, including acts of war, terrorism, acts of God, earthquake, flood, pandemic, epidemic, embargo, riot, sabotage, labor shortage or dispute, governmental act or failure of the Internet including, but not limited to, any disruption, failure and/or error in or of SHM’s internal computer systems, or any disruption, failure and/or error in or of any third-party Internet service providers as SHM may use from time to time. When applicable, paragraphs 8 and 9 of this Section shall govern.

- Third-Party Causing Partial or Full Nullification. The parties have contemplated in advance that upon any circumstance causing any portion of an Invoice to not be fulfilled within twenty-eight (28) days for any reason, then only said portion shall automatically be deemed null and void; and Customer shall be reimbursed accordingly and shall instruct SHM pursuant to paragraph 9 of this Section.

- Customer’s Reimbursement Election and Directive. Subject to Customer’s elected or required shipping method—as defined for Premium Insured Shipping, Standard Shipping, or Flat Rate Insured Alaska and Hawaii—as well as in all situations causing contemplated nullification, when any reimbursement is due to Customer as contemplated herein, then, as to such funds to the extent reasonably possible, Customer may instruct SHM to: A) apply such funds toward a new Invoice for the same, different, or similar product from SHM; B) return such funds directly to Customer by check or bank wire; or C) transfer such funds to Customer’s IRA account, if permissible and applicable under the account’s governing terms. SHM is not responsible for any fees or taxes incurred for elections under B or C. For purposes of this Agreement, where relevant, performance within twenty-eight (28) days is deemed complete when SHM abides by said instruction, including by initiating a transfer or placing the check in the mail.

IV. CONSIDERATION FOR PRODUCTS

- Products, Grading, Buy Back Policy, and Fees

- The Consideration due Client from Products. As to the product described in the Invoice, unless the item is specific to various aspects of Precious Metals that cause them to have differing values, things such as purity, year produced, condition, production Mint, country of origin, design features, etc., all have an effect on the fair market Numismatic value of the item purchased, then the items will be year varies and in standard condition but will be the specific item requested. Therefore if Customer desires something specific, Customer must notify SHM at the time that the Invoice is being prepared and must be reflected on the Invoice when Customer accepts the Invoice; SHM will make every effort to include all specific requests on the Invoice but it is the Customer’s ultimate responsibility to make sure their desired specificity is reflected on the Invoice. Absent such specificity, SHM will fulfill the requested items on Invoice with the product that is available. Meaning that if, for example, Customer desires 50 American Eagle gold coins, then SHM will fulfill that order with any available year, Mint and conditioned coins available so long as they are American Eagle gold coins. When the order is fulfilled by SHM’s vendor a specific list of the exact years, conditions, mints, etc. may be provided to SHM and in turn will be sent to Customer for record keeping.

- Grading of Precious Metals is not the business engaged in by SHM, that evaluation of the specific qualities noted in definitions to determine the approximate fair market value of a specific Numismatic Precious Metal or Bullion is left to professional companies noted in definitions. Like most appraisal processes the opinions may vary but it gives a general sense of value beyond its raw material or even fair market value. SHM is not a Grading service, and warrant no exact value of the Precious Metals in Numismatic form that are listed on the Invoice. SHM relies on the opinions of experts in this field when evaluating the amounts listed on Invoice.

- BUY BACK POLICY. As noted, the law prohibits Safe Haven Metal from guaranteeing to repurchase Precious Metals that we sell, and we do not guarantee that we will repurchase any Precious Metal item that you may purchase; what Safe Haven Metal extends is the possible availability as a buyer at a later date. If and when you desire to sell, simply call Safe Haven Metal at (323) 676-0558 and let us know you desire to sell the Precious Metals purchased from us subject to the following procedure that must occur:

i.) You must follow the shipping instructions on our sell to us page.

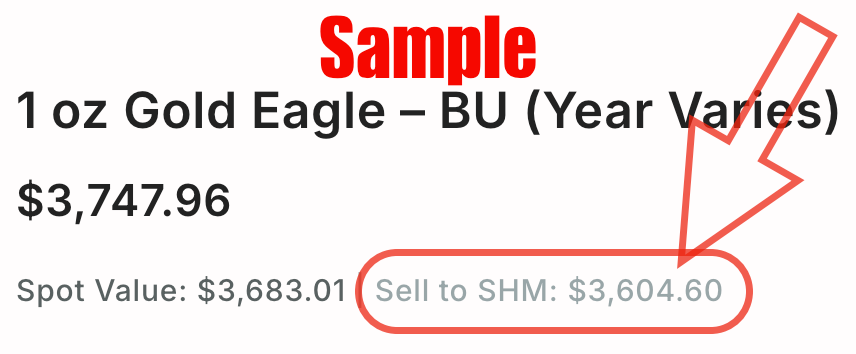

ii.) Look up the price for your item on our site, we list the price we will pay for any item on all sales pages. You can find the price as shown here:

iii.) The purchase is contingent on our examining the product to ensure it passes inspection (which is at our or our designated inspector’s sole good faith discretion as to current condition); if the product is as described then we will honor the price as locked in, if not we will discuss any adjustments warranted by the condition, however this is not a common occurrence. Please note, the offer is valid for 24 hours after inspection approval and new agreement sent.

iv.) Once signed and returned to Safe Haven Metal the money is then released to you within 72 hours; if you reject the adjusted offer then you must pay for return shipping costs and the product will be returned to you.

- Consideration Due SHM from Customer: The total amount listed on the Invoice is the amount that Customer agrees to pay SHM for the goods sold to Customer, and will complete Customer’s obligation to SHM unless otherwise provided herein.

V. Special Stipulated Damages Upon Specified Event

This Section applies to financial institutions and those who mean to effectuate fraud.

Notwithstanding any other provisions of this Agreement, the specifics of this Section shall prevail over all others as to the subject matter stated herein.

A. Purpose. All Parties named herein, find that libel and/or fraud is detrimental to the well-being and prosperity of the other party; and therefore, because such damages are inherently difficult to ascertain, and in order to promote speedy resolution without burdening the courts, and to ensure the availability of redress may be immediately enjoyed, hereby stipulate to the provisions of this Section.

B. Stipulated Damages. All Parties named herein hereby agree to stipulated damages that shall be the greater of:

1.) 75% of the purchase price as stated on the Invoice; or

2.) $50,000.

C. Triggering Events. All Parties named herein further stipulate that the triggering events to oblige either side to pay this stipulated damage will be:

1). upon delivery of the contracted for goods; and

2.) after payment has been made in good funds; and

3.) thereafter either the buyer or seller, or through their agent, intermediary, or financial institution, give any directive or make disparaging remarks to make an attempt or cause to pull back funds, initiate a return of funds, or obtain a refund of the funds, that were paid in full for the product as delivered.

D. Indemnify. Any financial institution acting on behalf of their account holder, that initiates a payment within the meaning of C.2., has by their conduct agreed to these terms and conditions, and will pay the stipulated damage and any applicable late payment penalties on behalf of their principal, subsidiary, or customer, should said entity/individual lack available funds to pay for the entire stipulated damage and any applicable late payment penalties.

E. Late Payment Penalty. All Parties named herein agree that this is fair and equitable, and shall pay the stipulated damages within thirty (30) calendar days of demand. If payment is not made within that period, an additional late payment penalty equal to ten percent (10%) of the stipulated damages shall be added on day thirty-one (31), and for each day thereafter that the amount remains unpaid, a daily late payment penalty of ten percent (10%) shall be applied on a compounding basis to the principal and accumulated penalties; and shall accrue automatically without the need for further notice. The Parties agree that this is fair and just by assuring each other of mutual performance should a triggering event occur. To provide a clear example of how such late payment penalty would compound, the following example is provided:

- Day 30 (initial): $50,000.00

- Day 31: $55,000.00

- Day 32: $60,500.00

- Day 33: $66,550.00

- Day 34: $73,205.00

- Day 35: $80,525.50

- Day 36: $88,578.05

- Day 37: $97,435.86

- Day 60: $872,470.11

F. Conforms to Industry Norms. The financial institution agrees to these terms and conditions as the entity engaging in the conduct that violates C.3. and therefore agrees that D. & E. are fair and reasonable. Furthermore, such an agreement is consistent with the imposition of Nacha Rules on parties not beneficiaries to such rules, and therefore the financial institution agrees that it is estopped from objecting. Finally because any financial institution must engage in diligence before engaging in any action that would violate C.3., the financial institution warrants that it has investigated the other party to the sale and therefore read these terms and conditions and knowingly acted with this obligation in mind and therefore its conduct shall constitute acceptance of and be deemed assent to these provisions.

G. Equal Application. These provisions apply equally to all Parties named herein, including buyers, sellers, and their agents, intermediaries and financial institutions. And therefore stipulate that no court shall reduce either the stipulated damages amount nor reduce any applicable late payment penalty as a part of the mutual assurances to each other.

H. Remedies. These provisions are cumulative and not exclusive. The non-breaching Party may also seek injunctive relief, costs, and attorneys’ fees and any other remedies available if the provisions of this Section are not fulfilled. Any dispute hereunder shall be governed by California law excluding its choice of law principles and stipulate to resolve the matter in Ventura County, California, except that injunctive relief may be sought in any competent jurisdiction as necessary.

I. Full and Final. Payment in full of the stipulated damage due and any applicable late payment penalties that may have accrued shall be deemed full and final satisfaction of the obligations due by the breaching party; unless the breaching party proceeds to litigate the provisions of this section thereafter, the Purpose thus being frustrated, then the matter will not be deemed fully and finally paid and penalties will continue to accrue in order to permit the breaching party the enjoyment of their rights under law.

J. Intent of the Parties. All Parties named herein agree that the mutual assurances of these provisions are just and proper between all concerned and therefore all provisions shall be construed only in a manner that permits enforcement. If any aspect cannot be construed under any imaginable theory then, and only then, may a competent court find it unenforceable and shall severe that portion only to the extent necessary and leaving the remainder as fully enforceable as if the severed portion never existed.

VI. Taxes

Under law, the Customer is responsible for payment of sales or use tax to the Customer’s state of domicile. Only when SHM has reached nexus will it begin collecting taxes and remit them on behalf of any particular state. As of now, the only state that SHM collects taxes on is California, all other Customers that receive metals in other states should review our tax information by state pages and remit sales taxes if and when required.

VII. THE LAWYER PART- Additional Clarifications and Resources

DISPUTE RESOLUTION; ARBITRATION OF DISPUTES; CLASS ACTION WAIVER.

VII. Arbitration Mutual Assent and Mutual Waiver

- This section sets out the binding, individual arbitration agreement and class waiver. This means that, subject to limited exceptions, any claim must be arbitrated on an individual basis pursuant to the terms set forth below; claims of different persons cannot be combined or aggregated, and both Customer and SHM understand and contemplate in advance that the expenses and uncertainty of litigation lead to a mutual waiver of the right to file a lawsuit in court and to have a jury or judge decide any dispute; instead both Customer and SHM agree to submit any claim to private arbitration. Please read this section carefully.

- This Agreement shall be governed in accordance with the laws of the State of California, USA, excluding its conflict of law principles, Choice of Law elected as California. Any action or proceeding in connection with this Agreement shall be brought before either the Judicial Arbitration and Mediation Services (JAMS) or American Arbitration Association (AAA), both located in Los Angeles County, California. Both Parties hereby consent to the personal jurisdiction of said venue and waive any claim for lack thereof. This Agreement shall not be governed by the United Nations Convention on Contracts for the International Sale of Goods, the application of which is expressly excluded.

- If arbitration shall be administered by JAMS then its arbitration rules govern. These rules may be found at https://www.jamsadr.com/adr-rules-procedures/

- If arbitration shall be administered by AAA then its arbitration rules govern. These rules may be found at https://www.adr.org/Rules also https://www.adr.org/Support

- If it would be a financial or other hardship for Customer to participate in an arbitration in Los Angeles, the Arbitrator has the authority to hold the hearing, or any part thereof, electronically or telephonically and to permit Customer to attend via videoconference, Zoom, Skype, Facetime, telephonic or similar virtual participation.

- Prior to initiating arbitration, any party hereto asserting any claim of cause for action and remedy, shall send a written statement to the other party describing with reasonable particularity the dispute and the relief requested as a demand. The parties shall attempt in good faith to resolve any such dispute promptly via direct communication and negotiations (between the parties and retained counsel, if any) over a period of fifteen (15) days or longer if it is reasonably necessary under the circumstances.

- If an accord cannot be reached and a lawful claim is felt still unremedied then either party may proceed as set out in the agreed upon path above, both sides shall bare their own attorney fees.

VIII. Usual Legal Boilerplate Inclusions

- NO IMPLIED WAIVER. The Parties agree that non-action regarding an actionable right is not a waiver of claim to that right unless said waiver is in writing, signed by the waiving Party, and delivered to the other Party.

- NOTICE. Unless otherwise specifically stated in this Agreement, any notice or other communication required under this Agreement shall be tendered in writing and be deemed delivered upon the earlier of: receipt by the other Party; or one business day after deposit with a commercial carrier for next business day delivery to the address indicated on the Invoice for Customer and SHM of this Agreement or at such other address as such Party may designate in writing with advance notice of any changes in accordance with this paragraph. SHM notices may be sent to by email at [email protected] or by mail at Safe Haven Metal LLC, 1000 Town Center Dr. Suite 300, Oxnard, CA 93036.

- ENTIRE AGREEMENT. This Agreement constitutes the entire understanding between the Parties regarding the subject matters contained herein. Any prior agreements, commitments or negotiations concerning the subject matters herein are superseded. There will be no amendment, modification or waiver under this Agreement except by written agreement signed by the Parties which specifically references this Agreement.

- HEADINGS. The headings contained herein are for the purposes of convenience only and are not intended to define or limit the contents of the provisions contained therein.

- FACSIMILE/ELECTRONIC SIGNATURES. This Agreement may be executed by a Party’s signature transmitted by facsimile or electronically, and copies of this Agreement executed and delivered by means of facsimile or electronic signatures will have the same force and effect as copies hereof executed and delivered with original signatures.

- COUNTERPARTS. This Agreement may be executed in two or more counterpart signature pages, each of which will be deemed an original, but all of which together will constitute one and the same instrument, if an original version is lost, then a copy is deemed a sufficient substitute.

- ASSIGNMENTNeither Party will assign or transfer any rights or obligations under this Agreement without the prior written consent of the other Party, which will not be unreasonably withheld. Any such assignment without prior consent shall be null and void.

- DELEGATION Customer understands and consents to SHM employ of third parties to perform necessary aspects to fulfill its obligations to Customer, when reasonably necessary SHM will delegate what is deemed necessary to timely deliver the product as contracted for to Customer.

- BINDING EFFECT This Agreement shall be binding on both parties and shall inure to the benefit or detriment of the parties’ their heirs and assigns or otherwise as a part of the mutual exchange of promises.

- SEVERABILITY. Should any portion of this Agreement be deemed invalid or unenforceable by an authority of competent jurisdiction, then said portion shall be changed and interpreted so as to best accomplish the objectives of the Parties; and if it cannot, shall be severed here from with the remaining portions of Agreement continuing with full force and effect as if the severed or altered portion never existed.

Binding Effect

The execution of the sale shall manifest the Parties’ free and voluntary entering into this agreement, by duly authorized representatives, with intent to be bound hereby, this Agreement as of the date that the Purchase Order was executed, and do mutually so bind evidenced by proceeding with the sale on this site.

SAFE HAVEN METAL LLC, 1000 Town Center Dr. Suite 300, Oxnard, CA 93036

Adopted and binding by managing members.

Fixed broken hyperlink to section V at top of page.

Included an introductory sentence in section V to make the content even more clear for anyone that does not read the clear provisions.

2025-07-08

Revisions effective as of July 8, 2025: adopted standard physical contracts, changing the majority of prior terms on the first half, but leaving most of the second half.

2025-12-02

Adjusted provisions to match the PDF versions.

2025-11-11

Revisions effective as of Nov. 11, 2025: Section 3 (major revisions to clarify structure); Added definitions re shipping; Clarified Cancelation timing.

July 2025: Section 5 (major revisions); Section 7b clarifying language added; Small non-substantive changes or corrections made in various other locations, including adding additional links.

Prior Revision Date: April 4, 2024