Breaking Down Bullion from Perspectives of Historical, Scientific and Legal Aspects

The Oxford Dictionary defines Bullion:

Noun

“gold or silver in bulk before coining, or valued by weight: [with modifier] : gold bullion.”

Bullion’s Science

After the refining process of smelting that removes nearly all other impurities, in most cases the result is a metal alloy that is .9999% pure.

In total there are eight precious metals — gold (Au), silver (Ag), platinum (Pt), iridium (Ir), palladium (Pd), rhodium (Rh), ruthenium (Ru), and osmium (Os). A precious metal is a rare metallic element of high economic value. Also called noble metals because they resist most types of environmental and chemical attack. Only copper and precious metals are in their metallic state in nature. All other metals require processing from minerals or ores into metals. The result is inherently unstable and have a tendency to revert to their more stable mineral forms. Hoffman, J. (2008) Materials Engineering: Little-known facts about precious metals. MachineDesign.com

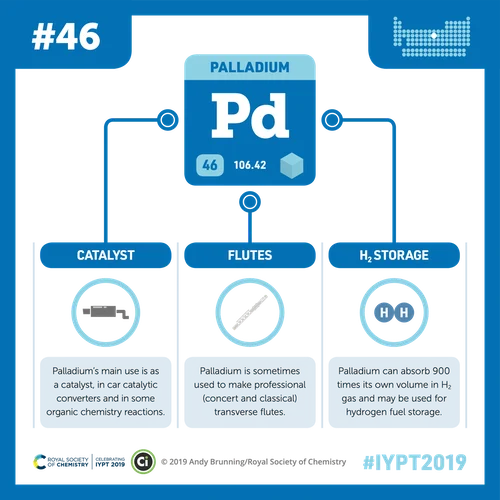

Element 46. Palladium Bullion

Palladium is a lesser-known precious metal. However, you are more aware of Palladium’s utility than you might know. Palladium is vital to the automotive industry. Catalytic converters and catalysts in industrial processes are dependent on Palladium. Therefore, becoming increasingly popular due to its potential for portfolio growth. You can purchase Palladium bullion in the form of bars and coins. Sizes range from 1 oz. to 10 oz. Palladium is a beautiful metal as a proof coin. Read more here.

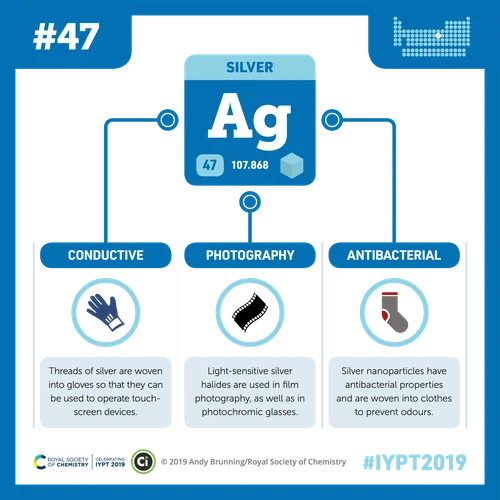

Element 47 Silver Bullion

Silver bullion has always been a popular choice, due to its simple clean luster, versatility and most of all, affordability. The green revolution has sparked higher than ever demand for Silver because it is used in a variety of industrial applications, e.g., solar, electronics and computers, which has increased demand for the noble metal. Silver bars and coins are available in a range of sizes, from 1 oz. to 100 oz. or more, making it easy to buy and sell as needed.

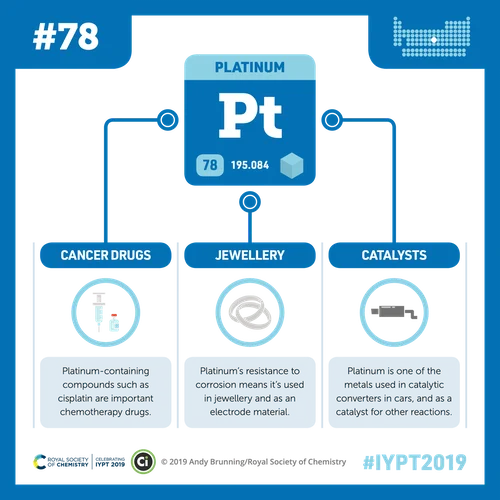

Element 78 Platinum Bullion

A relatively rare metal, Platinum is often used as well for catalytic converters in the automotive and of course in the jewelry industries. Platinum bullion is available in the form of bars and coins, and its value is often higher than that of gold due to its scarcity. Platinum bullion is typically sold in sizes ranging from 1 oz. to 10 oz.

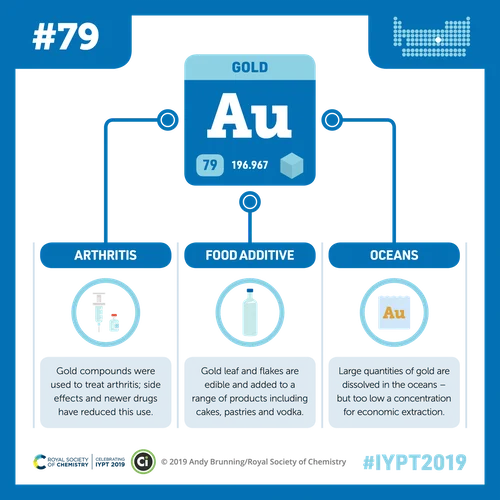

Element 79 Gold Bullion

Gold is perhaps the most well-known and highly valued precious metal, its elemental symbol on the periodic table Au derives from the Latin word Aurum which meant shining dawn. Our English word is of Dutch goud and Germanic origin gold, which meant yellow.

As will be explained below, It is often used as a store of value and a hedge against inflation. Gold bars and coins come in a range of sizes, from 1 gram (called fractional) up to 400 oz. or 12.4 kilogram or 27.5 pounds (called Good Delivery bar). Chances are you will never get the chance to lift a Good Delivery bar as the classic bar we see in movies, because in reality they are only used by banks when transferring wealth around. Besides who wants to carry around a near 30 lbs. dumbbell worth $800,000? Making the past chore of breaking a $100 bill, seem not so daunting a task.

If you still need more raw science data about these beautiful precious metals, or any metals for that matter, the above periodic table cards and so much more purely scientific information can be read here.

Bullion’s Evolution

The above scientific reasons explain the pragmatism behind why these metals were used for coinage over millennia. Then of course their inherent intrinsic beauty has equally kept them popular in society, well at least as to four of the eight, and copper as well. As society grew and the science of economics evolved, precious metals naturally inured into the equations formulated to track wealth, stability and growth potential.

The Rise of the Note

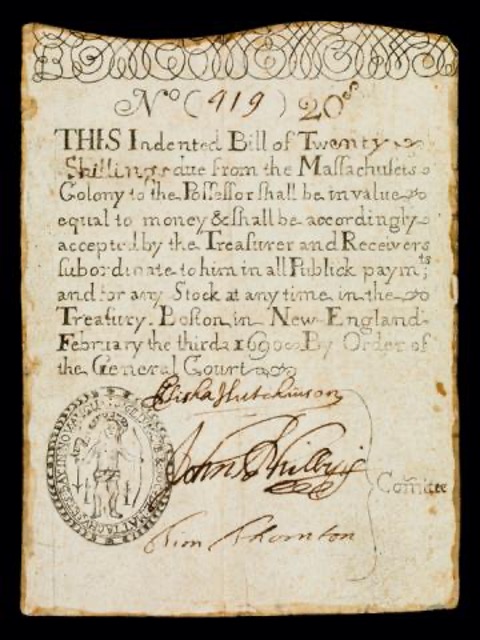

As time steadily marched forward and wealth grew, paying debts with a purse of coins became burdensome and not practical. The wealthy resorted to notes, literally.

Obligations would be memorialized as a note and held value based on the issuer. The common classes were less in need of such conveniences and after many attempts by the government, it was President Lincoln that eased worries by having the government directly promise with “demand notes” in 1861, that upon demand a $10 note could be exchanged for gold or silver. Then silver certificates would be employed in 1878 in yet another effort to replace silver coins with common notes.

Uniformity of Money Implemented

Originally the several mints would print their own official money. But in 1928 the Federal Reserve standardized all US currency with our modern “federal reserve note”. Yet the populace finally let go of their trust only in bullion as currency, over 100 years after demand notes. In 1965, the Treasury stopped coin production using actual silver. Up until 1968 silver certificates could be redeemed for their value in silver with the U.S. Treasury.

It is not surprising that precious metals have long been, and are still a popular source to turn to for financial stability and as a way to diversify portfolios. Perhaps most of all to protect against inflation.

Other mediums can serve as vehicles for the transfer and storage of wealth. Precious metal bullion, in particular, is the preferred tangible asset of security. It can be easily bought and sold. The federal reserve declares the US dollar a major liability. Thus bullion is a convenient way to convert a liability into the historic metals of silver, gold, platinum, and palladium.

Bullion’s Modern Substance

When we speak of bullion we are referring to its near elemental isolation. As consumers, we think in terms of its physical presence in the form of jewelry, and bullion as geometric objects. All precious metals in bullion form are generally divided into bars or circular objects. Introduced as circles because the terms coins and rounds are often used incorrectly.

Coins are minted by a sovereign government authorized to create currency as legal tender. A minimum face value denomination is ceremonially imprinted on its face, e.g., $5, $10, $25, $50. Yet everyone knows, its melt value controls. Their design requires legislative approval and is highly specific. The United States Code sets out in great detail all aspects of each coins features and dimensions.

31 U.S.C. § 5103 (“United States coins and currency (including Federal reserve notes and circulating notes of Federal reserve banks and national banks) are legal tender for all debts, public charges, taxes, and dues. Foreign gold or silver coins are not legal tender for debts.”)

Private mints are forbidden from producing legal tender. By law, rounds are not coins. Nor do they require the legislative approval process. However, they come in a great many different styles and designs.

The term Numismatic or semi-numismatic refers to value added to a coin or round beyond its initial weight. Technically, numismatic has all of its value as being based on something other than weight. Semi-numismatic (aka proofs) partially derive its value from its weight, and added value from something else.

Coins are by Congressional Decree

Coins generally come in 1/10 oz, 1/4 oz, 1/2 oz, and 1 oz weights. There is one major significant difference between the two. Rounds are forbidden from having the same diameter, thickness, and weight as a legal tender coin. 31 U.S.C. § 5112 (“(q) (5) LEGAL TENDER. The coins minted under this title shall be legal tender, as provided in section 5103.”) Which is why federal law publishes the exact specifications.

31 U.S.C. § 5112 (“(a) The Secretary of the Treasury may mint and issue only the following coins:

(7) A fifty dollar gold coin that is 32.7 millimeters in diameter, weighs 33.931 grams, and contains one troy ounce of fine gold.

(8) A twenty-five dollar gold coin that is 27.0 millimeters in diameter, weighs 16.966 grams, and contains one-half troy ounce of fine gold.

(9) A ten dollar gold coin that is 22.0 millimeters in diameter, weighs 8.483 grams, and contains one-fourth troy ounce of fine gold.

(10) A five dollar gold coin that is 16.5 millimeters in diameter, weighs 3.393 grams, and contains one-tenth troy ounce of fine gold.

(11) A $50 gold coin that is of an appropriate size and thickness, as determined by the Secretary, weighs 1 ounce, and contains 99.99 percent pure gold.

(12) A $25 coin of an appropriate size and thickness, as determined by the Secretary, that weighs 1 troy ounce and contains .9995 fine palladium. (b) … In minting gold coins, the Secretary shall use alloys that vary not more than 0.1 percent from the percent of gold required. The specifications for alloys are by weight.”)

Details in the Law Make the Coin Recognizable

Can you figure out which coin this is by its description?

31 U.S.C. § 5112 (“(i)(1) Notwithstanding section 5111(a)(1) of this title, the Secretary shall mint and issue the gold coins described in paragraphs (7), (8), (9), and (10) of subsection (a) of this section, in qualities and quantities that the Secretary determines are sufficient to meet public demand, and such gold coins shall-

(A) have a design determined by the Secretary, except that the fifty dollar gold coin shall have- (i) on the obverse side, a design symbolic of Liberty; and (ii) on the reverse side, a design representing a family of eagles, with the male carrying an olive branch and flying above a nest containing a female eagle and hatchlings;

(B) have inscriptions of the denomination, the weight of the fine gold content, the year of minting or issuance, and the words ‘Liberty’, ‘In God We Trust’, ‘United States of America’, and ‘E Pluribus Unum’; and

(C) have reeded edges.”)

How about this one?

31 U.S.C. § 5112 (“(e). Notwithstanding any other provision of law, the Secretary shall mint and issue, in qualities and quantities that the Secretary determines are sufficient to meet public demand, coins which-

(1) are 40.6 millimeters in diameter and weigh 31.103 grams;

(2) contain .999 fine silver;

(3) have a design-

(A) symbolic of Liberty on the obverse side; and (B) of an eagle on the reverse side;

(4) have inscriptions of the year of minting or issuance, and the words ‘Liberty’, ‘In God We Trust’, ‘United States of America’, ‘1 Oz. Fine Silver’, ‘E Pluribus Unum’, and ‘One Dollar’; and (5) have reeded edges.”)

Summation

Gold is manifest destiny. We turn to it for security because it has always been there for us, making it rather needed. If you have read our Special Report Central Banks, then you know how the banks revere it. Iif you have not read it yet, then it is a must read. Learn why liquid cash, according to the banks, is a dangerous asset to be holding.